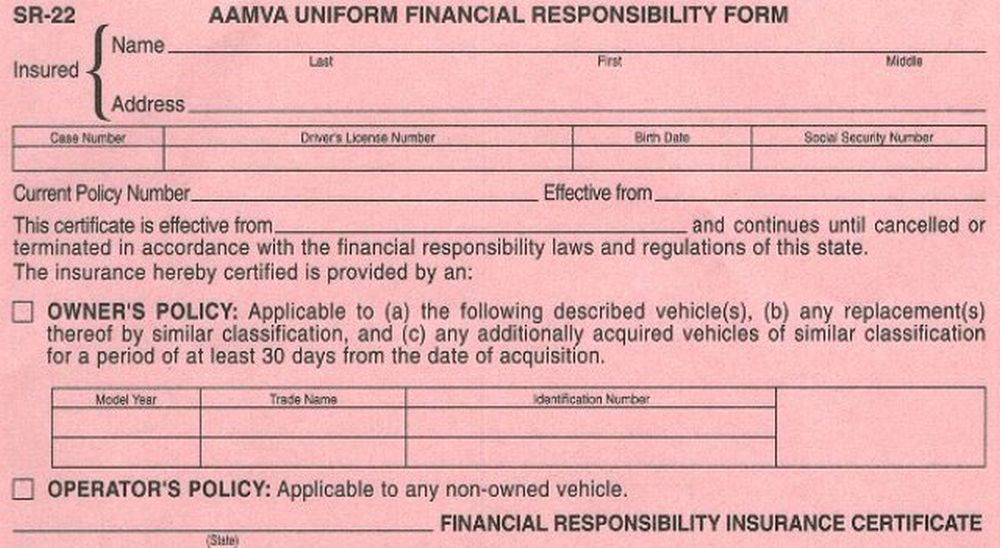

Are you looking for low-cost insurance but don’t know where to start? Have you been told that you need to provide an SR-22 to unlock cheaper insurance? SR-22 is a form that some states require to prove you have car insurance and get it to the state’s Department of Motor Vehicles (DMV). Most states require an SR-22 when a driver is convicted of certain driving- and insurance-related offenses.

An SR-22 is not an actual insurance policy. It is a form that most insurance companies will file with the DMV to prove that you have car insurance. It can help you access lower-priced insurance options from most major name-brand providers. That means if you or someone in your household has an accident or is convicted of a traffic violation, you’ll likely save with an SR-22 policy.

Unlock low-cost insurance with SR-22 with a few simple steps. First, understand what an SR-22 is and why you need it. Secondly, shop around for quotes and determine which type of coverage is best for you. Thirdly, consider ways to save on premiums. Finally, select an insurance provider to submit your SR-22 form and make sure your coverage is up to date.

Qualifying for an SR-22 lowers the overall cost of your car insurance premiums. Insurers generally charge more for drivers with traffic violations and accidents. With a low-cost SR-22 policy, you may be able to secure better rates with essential coverage options. With the right coverage, you can rest assured knowing youll have an SR-22 form on file with the DMV and a low cost car insurance policy to protect your finances.

For those seeking the lowest possible rates for their SR-22, consider bundling multiple policies together. You may be able to bundle different types of coverage, such as auto, home, and life insurance, to unlock savings. In addition, you can find discounts based on your location, vehicle type, and driving habits. With the right policy mix and discounts, you can find a cost-effective SR-22 that meets your needs.

Its also important to understand the additional fees that come with an SR-22 form. Insurance companies typically charge filing fees when submitting an SR-22 form. These fees can vary depending on the plan and the provider, but can range from $25 to $50. Its important to factor in these fees when considering the overall cost of an SR-22 policy.

Finally, when it comes to finding an SR-22 policy, it pays to research your options. Compare quotes and coverage to find the policy that best fits your budget. Many insurers offer specialized SR-22 policies that are tailored to meet your needs. With the right policy, you can find low-cost insurance and peace of mind.

Unlock Low-Cost Insurance With SR-22: Four More Perspectives

1. Understanding Your Options – Before purchasing an SR-22 policy, review your different options to make sure youre getting the right coverage for your specific situation. Many insurers offer discounts or special deals for SR-22s, so it pays to shop around and compare quotes. Also consider different coverage options, such as comprehensive or liability coverage, to make sure youre protecting yourself from any risks.

2. Consider Different Payment Plans – As you shop for an SR-22 policy, look for a payment plan that fits within your budget. Most insurers offer payment plans on SR-22 policies where you can pay premiums on a monthly or quarterly-basis. By exploring the different payment options, youll be able to find a cost-effective policy that meets your needs.

3. See if Your Employer Offers Discounts – Many employers offer special discounts to their employees for purchasing an SR-22 policy. Check with your HR department to see if there are any discounts or offers for purchasing an SR-22 policy.

4. Long-term Savings with an SR-22 – Purchasing an SR-22 policy can unlock long-term savings on your car insurance premiums. With the right coverage and discounts, you can find an SR-22 that meets your needs while saving you money. If youre looking for ways to save, an SR-22 policy may be the perfect solution.